Winter 2022

Risk management toolbox

America’s nut producers are a critical part of the farm economy that feeds our nation – and the world. Approximately 80% of the world’s almonds are grown in California, while pecans are a top crop in New Mexico and macadamia nuts top the list in Hawaii.

Cultivating a successful tree nut crop not only requires an immense amount of skill and dedication, but it also requires some help from Mother Nature. Unfortunately, Mother Nature does not always cooperate, and losing a crop in a disaster can devastate a family farm.

A strong farm safety net helps farmers manage the challenges and risks that come with farming, and crop insurance stands as its cornerstone.

Cornerstone of the farm safety net

Crop insurance is an integral part of a farmer’s risk management toolbox. It’s similar to other common types of insurance in that farmers must pay premiums to first purchase coverage, and then they shoulder deductibles when disaster strikes.

However, crop insurance relies on a unique public-private partnership to leverage the efficiency of private-sector insurance companies to deliver aid quickly while sharing the risk among farmers, insurance companies and the government. That’s because in farming, a single event – such as the drought currently being experienced by much of the American West and Northern Plains – can cause a wide-scale catastrophic loss over an entire county or region.

The federal government also regulates crop insurance, ensuring that crop insurance is available to all eligible farmers, no matter what they grow or where they grow it. In short, crop insurance keeps America growing.

While some might traditionally associate crop insurance with row crop production, it helps keep America’s tree nut producers growing, too. Today, crop insurance protects more than 130 different commodities across 440 million acres of cropland in all 50 states. That’s more than 90% of insurable acreage.

Federal crop insurance policies are available for a variety of nut trees, including the production of pecans, macadamia nuts, walnuts, almonds and pistachios.

Whole-Farm Revenue Protection also allows producers to insure a variety of commodities, giving tree nut producers with diversified farms more flexible, affordable risk management options. (Hazelnuts do not have a specific policy available for coverage, but if a grower purchases a Whole-Farm Revenue policy, the revenue from that crop can be protected as part of the whole farm policy.)

Nut producers face unique risks

Devon Yurosek is a California producer who grows pistachios and almonds – along with several tree fruits – on the family farm that his grandfather started three decades ago. As a farmer in California’s Central Valley, Yurosek has experienced both the highs of growing in the valley’s rich soil and the lows of dealing with uncertain rainfall and mild weather that can affect nut production.

Yurosek has turned to crop insurance to help manage his risks.

“In good years, we never look to get any money from crop insurance. It’s the bad years we are looking to cover,” he said.

America’s farmers and ranchers face any number of risks on a daily basis that are insurable with crop insurance, including adverse weather, pests or disease. However, tree nut producers face their own set of unique challenges. For almond trees, for example, too much rain during the blooming season can discourage pollination or encourage disease.

Unlike one-off disaster bills, which can be slow to deliver aid, crop insurance can provide assistance in just days or weeks to help tree nut producers weather unexpected perils.

Crop insurance also has the flexibility to quickly respond to new challenges. So, as America’s farmers are on the front lines of the fight against climate change, crop insurance is complementing efforts to incentivize the adoption of climate smart farming practices that increase resiliency, improve conservation and support a healthy environment.

All of this works to keep food moving to America’s tables while supporting multi-generational family farms.

“I’m incredibly fortunate to be part of a family farming operation,” Yurosek said. “It’s about providing jobs and providing healthy, beneficial food for the world, but especially for the United States.”

Talk to a crop insurance agent

One of the strengths of crop insurance is that it can be tailored to meet the individual needs and risks of each farmer. That is why it’s important for growers to talk to a local crop insurance agent about the needs of their farming operations.

A crop insurance agent can help growers understand the available policies and their provisions – including insurable causes of loss and important deadlines – to ensure that growers are prepared to face any disasters that might come their way.

Just as tree nut producers face unique risks, their crop insurance considerations are unique as well. Producers should be prepared to answer questions about the specifics of their operation, such as the age of their trees. Orchards may be insurable based on the number of growing seasons and their production records.

Almond producers will also want to be cognizant that they have provided an adequate number of bee colonies to ensure sufficient pollination. An insurance claim on an almond loss could be denied due to a failure to provide enough bee colonies in the orchard.

It’s also key to talk to a crop insurance agent about the timelines and deadlines for coverage. When purchasing a new policy, there are important deadlines that must be adhered to in order to properly cover tree nut crops for the upcoming season. Some policies may also require that the insured acreage is inspected before insurance attaches.

Crop insurance policies on tree nut production are continuous policies, meaning that if a grower meets the policy reporting requirements, there is never a gap in the insurance policy. However, for pistachio and pecan policies, coverage is sold in two-year modules, due to the crop’s biennial fluctuation in yields.

America’s crop insurance agents are a grower’s best resource to learn more about how investing in crop insurance can benefit the farmer and the farm. With several insurance deadlines approaching this winter, it’s important to talk to an agent today. Growers can find a crop insurance agent by visiting the USDA Risk Management Agency’s agent locator at www.rma.usda.gov/Information-

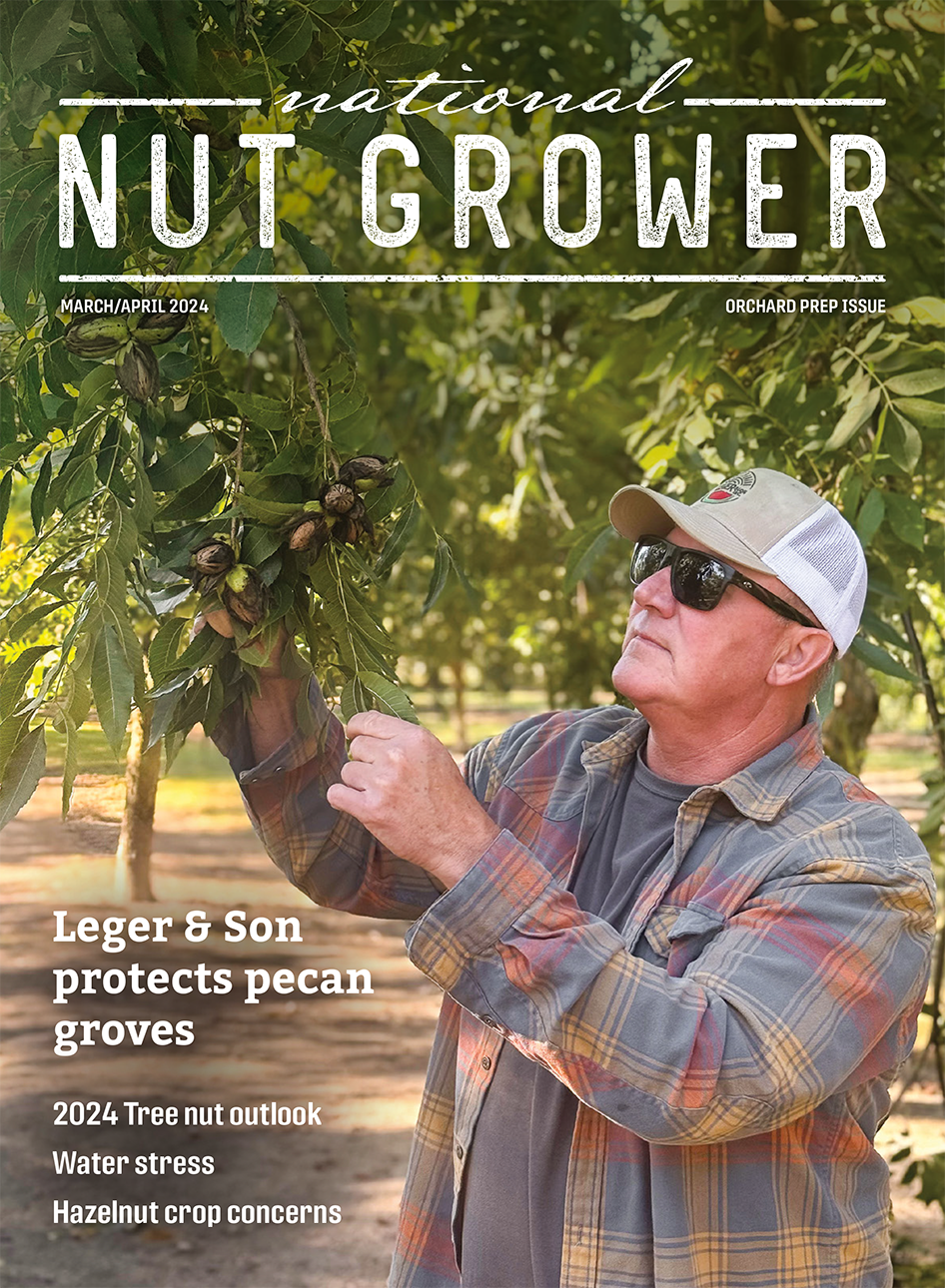

Photo: Federal crop insurance policies are available for a variety of nut trees. Pecan (and pistachio) coverage is sold in two-year modules.