The knock on Lakota has been the variation in nut size even from the same tree but since almost all pecans are sized as they come through the cleaning plant now, I don’t see this as a major problem. Another issue it faces is the fact that the kernel color turns dark in certain years. I will discuss this further later.

For now, lets focus on Lakota’s production:

| Year | Yield (lbs/A) |

Nuts/lb | % kernel | Cost | Price | Gross $ | Net $ |

| 2018 | 2058 | 48 | 60 | 1184.30 | $1.95 | $4013.10 | $2828.80 |

| 2019 | 394 | 48 | 57 | 1124.08 | $2.30 | $906.20 | $-217.88 |

| 2020 | 4296 | 63 | 54 | 1024.08 | $1.35 | $5799.60 | $4775.52 |

Yields of Lakota have been excellent and quality has been pretty good. The yields you see here are based on taking the per tree average yield and multiplying that by 27 trees per acre (40 X 40 spacing). The cost of production includes fertilizer, herbicide, and mowing. A few insecticide sprays were applied in 2018 and 2019 but none were necessary in 2020. Actual cost of production is likely a bit lower than what you see here because we did not take into account the fuel savings from having zero fungicide sprays. All prices were actual prices obtained from accumulators.

As you can see, Lakota will alternate bear significantly if left unchecked. In order to alleviate this problem we fruit thinned three Lakota trees in 2020.

We will learn this year whether or not fruit thinning improves the return crop of ‘Lakota’. Yields and returns, etc. for thinned and non-thinned trees can be seen below.

| Fruit Thinned | Yield | Nuts/lb | % kernel | Cost | Price | Gross | Net |

| Yes | 2986 | 63 | 56 | 1024.08 | $1.35 | $4031.37 | $3007.29 |

| No | 4296 | 63 | 54 | 1024.08 | $1.35 | $5799.60 | $4775.52 |

Net returns of ‘Lakota’ have been exceptional in the ON year. But as you can see from Table 1 earlier, the very low off year is an issue. Still, some would say if you can net around $3000/acre on average, you can stand an off year. I would prefer to see consistent production. If we can eliminate the alternate bearing tendency of Lakota by mechanical fruit thinning or hedging and even-out production, we will have solved one of Lakota’s major issues.

The other major issue ‘Lakota’ faces is its kernel color. The kernels turn dark quickly if not harvested on time. You can see the color of the Lakota kernels from our trees in 2020 on the left in the image below as compared to Excel on the right.

This is not really what you want to see and its the first year we have seen the kernels turn this dark in our trial (although I have heard others complain about this issue in the past). These nuts did lay on the ground longer than normal this year and the trees were overloaded, which we thought may be a contributing factor. However, fruit thinning did not improve the kernel color.

If you were wanting a nut to shell for mail-order or gift pack, Lakota would certainly not be your nut of choice. However, Lakota shells out well into complete halves. I have shown the color to a few shellers and the reviews are somewhat mixed. One sheller told me he does see it as an issue. Two others have told me it won’t really matter going into the domestic shelling market. I have seen similar color on Western varieties and from nuts out of Mexico as well. One sheller even told me that its only folks in Georgia who are hung up on the color and that much of the commercial shelling market won’t care. The question becomes, how much of this would the market bear?

So, is there a place for ‘Lakota’? Although I am somewhat tentative since we only have 3 years worth of data and the color issue is still concerning, based on the actual numbers we see, I would say yes. When you can grow them this cheap, you don’t have to get a high price to be profitable. Even when compared with Desirable and Pawnee, no other cultivar I see except perhaps ‘Creek’ can generate the volume and income of ‘Lakota’ with such a low cost of production. Production and prices for the two would be very similar, you will have to manage crop load on both, and both can be grown with a light spray program. I don’t know of many crops in the SE, much less pecan varieties, from which you can generate $3000 per acre or more in net returns. Though I have not shared them here, the numbers for ‘Excel’ have looked nearly as good, bumping up on almost $3000 per acre net. However, in the absence of an in-shell market, the price of Excel has been lower than for Lakota most years as a result of the difficulty in shelling them out into complete halves.

Even though we did not spray the Lakota in this trial I would not advise making zero fungicide sprays in a commercial orchard setting. We see powdery mildew on Lakota and while it does not seem to have affected our yields or quality to date, left unchecked it could develop into an issue over time. In addition, a minimal scab program would likely help protect Lakota’s current scab resistance. I would recommend making 2 to 3 fungicide sprays with Lakota.

– Lenny Wells is a Professor of Horticulture and Extension Horticulture Specialist for pecans at the University of Georgia. His research and Extension programs focus on practical cultural management strategies that help to enhance the economic and environmental sustainability of pecan production in Georgia.

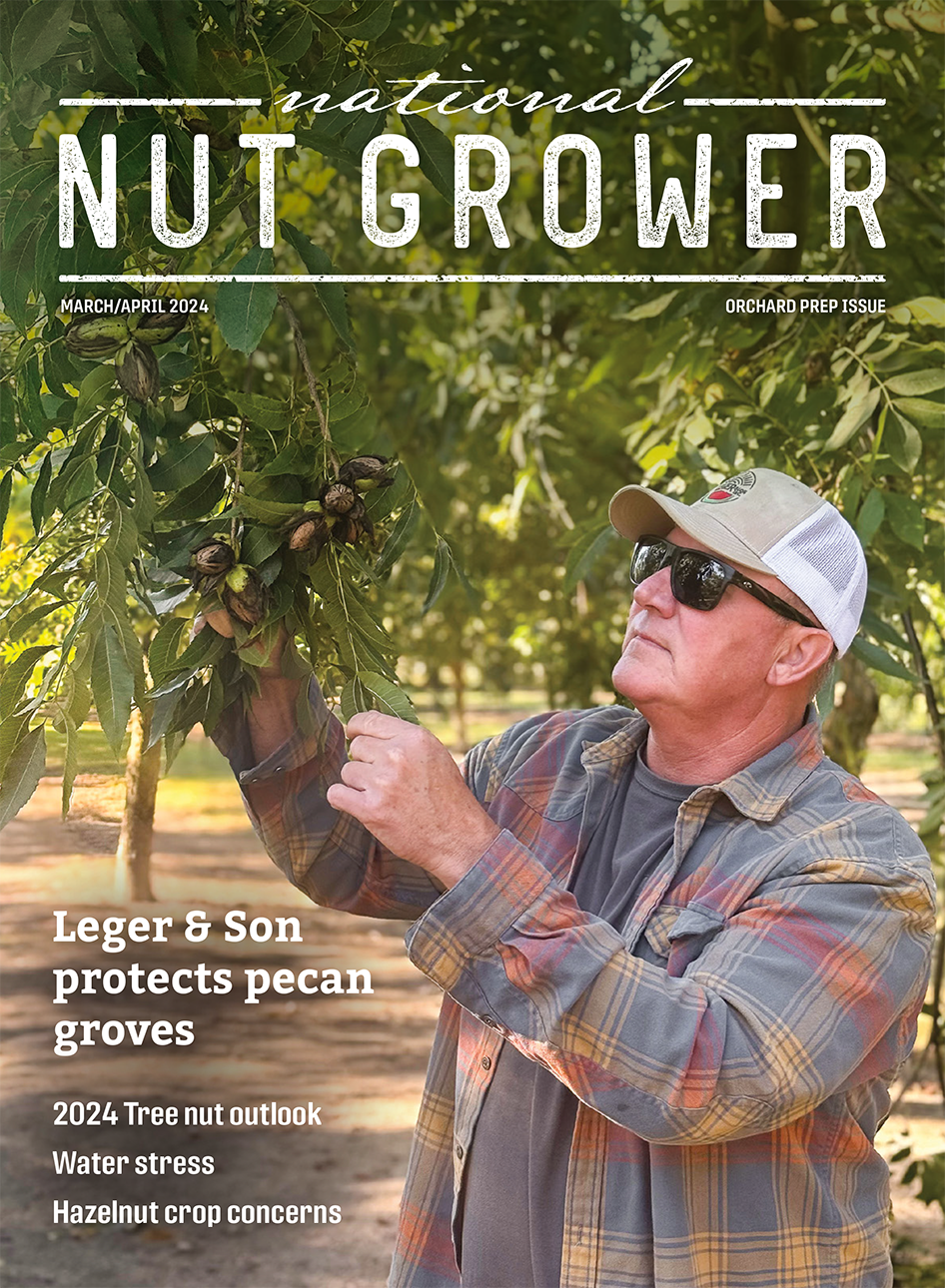

Photo above: ‘Lakota’ pecans.