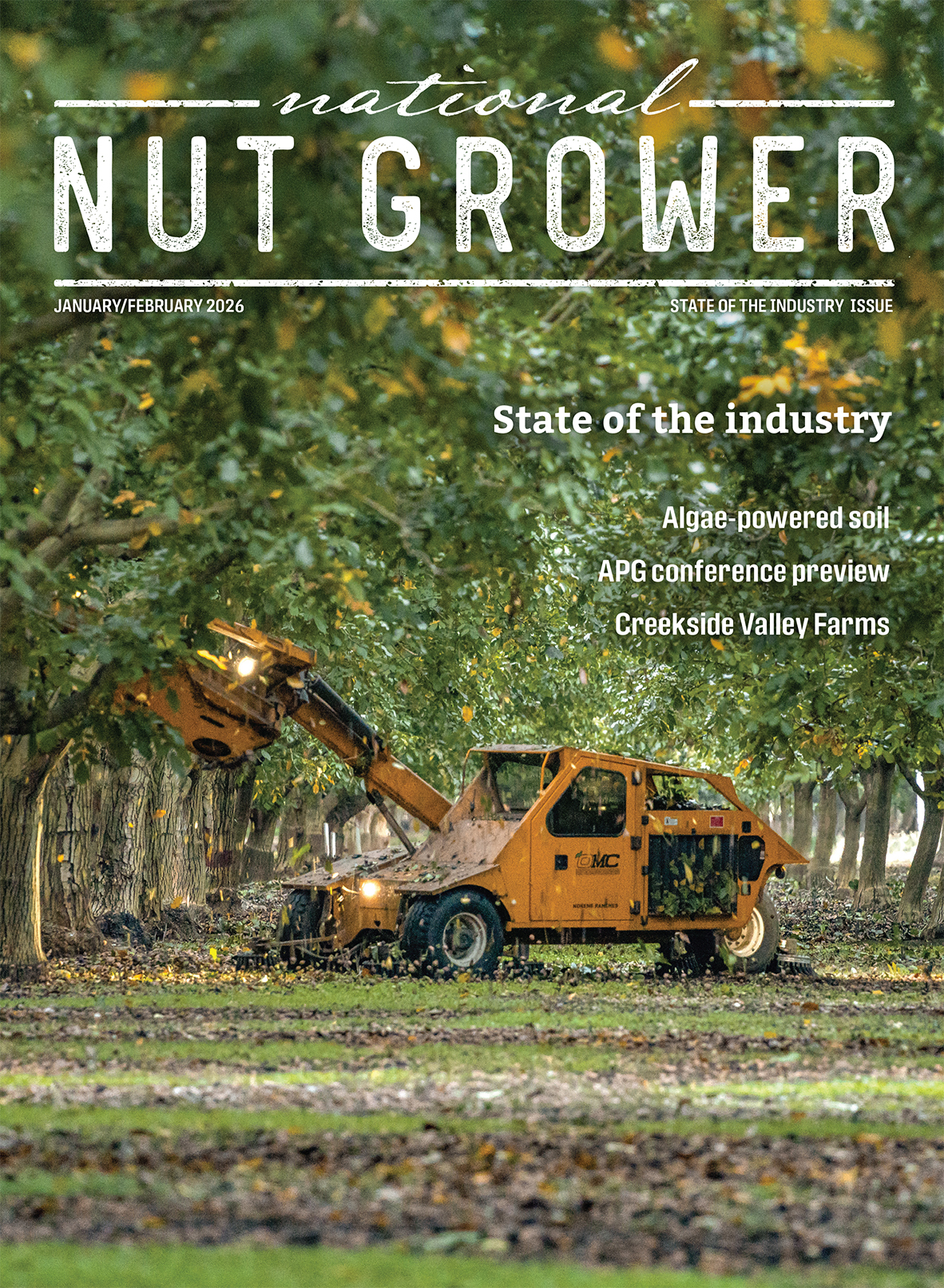

January/February 2026

2026 is the year of the pistachio — again

The American pistachio industry entered the 2025-26 marketing year with uncommon momentum. Growers harvested a record 1.571 billion pounds in receipts as of October 31, 2025, according to the Administrative Committee for Pistachios (ACP), and early shipments ran 9% ahead of last season.

Those facts would make headlines in any commodity but only hint at the full story: Acreage planted earlier in the decade is now coming into production, domestic demand remains resilient and export markets show pivotal gains despite a turbulent tariff environment.

The record 2025 crop

While pre-season estimates varied, the 2025-26 harvest ultimately set a new high for U.S. pistachios. ACP’s October shipment report tallied 1.571 billion pounds in total receipts, translating to 1.34 billion pounds of marketable inventory, a 4% rise over the most comparable one-year period (October 2023-24). Combined shipments through October reached 197.18 million pounds, driven by 44.20 million pounds domestically and 152.98 million pounds in exports.

The production surge reflects a multi-year arc of acreage expansion and maturing trees. Bearing acreage has grown dramatically over the past decade, with pistachios favored for returns and resilience to salinity and drought — key drivers of sustained plantings since 2012. This growth underpins handlers’ ability to support record throughput with quality control and diversified portfolios.

Domestic momentum

![]() On the home front, U.S. pistachio consumption continues to expand, supported by nutrition-forward messaging, private-label innovation and increased retail-facing presence. American Pistachio Growers (APG) research and investments continue to unlock this versatile superfood.

On the home front, U.S. pistachio consumption continues to expand, supported by nutrition-forward messaging, private-label innovation and increased retail-facing presence. American Pistachio Growers (APG) research and investments continue to unlock this versatile superfood.

2025-26 domestic shipments edged above last year’s pace in October, signaling that the category’s baseline demand has deepened over multiple cycles. Kernel demand has proven resilient. Even when export headwinds arose earlier in 2025, handlers reported kernel shipments up year-over-year, with some in-shell product cracked to meet kernel needs — a tactic that remains relevant as confectionery and ingredient channels broaden.

That cadence, combined with alternate-bearing dynamics, has nurtured inventory discipline — supporting stable pricing amid global supply fluctuations.

Pistachios’ higher gross returns per bearing acre support permanent plantings, reinforcing grower confidence and investment in orchard health, harvesting efficiencies and processing capacity.

In 2026, that foundation will support value-added kernel applications and premium in-shell formats across U.S. retail and foodservice, with APG leading this expansion.

International landscape

U.S. pistachio shipments declined through March 2025 due to losses in the EU, China and Turkey amid inspection stringency and tariff noise, but kernel shipments rose and domestic movement held steady.

By late 2025, conditions improved. ACP’s October numbers showed broad export gains to Vietnam, Italy and multiple Middle Eastern destinations, as buyers quickly adjusted after early-season price shifts.

China: Strategic priority, shifting policy

China remains a strategic linchpin. Late-2025 APG updates flagged suspension of two retaliatory tariff layers, improving tariff navigation. 2026 shipments could benefit from clearer customs and marketing despite policy risks.

Mexico: Premium positioning and policy work

In Mexico, APG reported surging consumer interest — especially in kernels — with pistachios positioned as a premium product across retail and menus. Parallel nutrition research supports advocacy seeking exemptions from Mexico’s snack tax, a policy outcome that could further catalyze demand in 2026.

India, Europe and MENA: Durable growth channels

Trade press and International Nut & Dried Fruit Congress coverage point to India as a hot growth market and Europe, the Middle East and North Africa (MENA) as enduring anchors for premium-grade U.S. product.

U.S. in-shell and high-quality kernels maintain advantages in consistency and food safety. Europe’s demand strengthened, and MENA buyers expanded allocations, especially in the UAE and Saudi Arabia.

Global supply picture

Despite the U.S. entering 2025-26 with a bumper crop, global production estimates trended lower than 2024-25 due to sharp declines in Turkey and tempered flows from Iran.

Turkey’s carryover lifts global supply as new-crop output falls. U.S. pistachios gain from reliability, though kernel competition rises from Iran.

2026 outlook: Four themes to watch

Acreage maturity and yield management

California’s pistachio-bearing acres have surged over the last two decades, and industry projections show bearing area approaching roughly 590,000 acres by 2028.

In 2025 estimates, analysts saw younger trees performing below 2023 levels, a reminder that block age and cultural practices will modulate average yields in any “on” year. Focus will remain on alternate-bearing mitigation and on-farm technology to stabilize yields and quality.

Kernel-forward innovation

Confectionery and ingredient buyers are fueling a kernel-led expansion, pushing handlers to flex cracking capacity and quality grading.

This trend will intensify as brands scale pistachio-forward SKUs — from chocolates and gelato to snack mixes and baking inputs — responding to consumer cues on protein, healthy fats and clean labels. Kernel demand will keep premiums firm and reward handlers with robust QA/QC.

Trade policy risk and resilience

The tariff landscape will remain a variable. While China’s suspension of specific retaliatory layers was a positive late-2025 pivot, broader trade uncertainty has proven disruptive.

Pistachios have shown relative resilience, but handlers should plan for policy whiplash, keeping flexible allocations and hedging via diversified geographies.

Quality, safety and brand storytelling

European scrutiny of contaminants elevated the premium on compliant supply chains in 2025. U.S. pistachios benefit from stringent quality systems, a brand story rooted in U.S. agriculture, sustainability and nutrition science.

In 2026, pairing technical assurances with consumer education will continue to unlock category growth and sustain price integrity.

Domestic horizons

American consumers continue to embrace pistachios as a mainstay in healthy snacks. Retailers have expanded shelf space and introduced private-label options and new flavors. Food service continues to feature pistachios in Mediterranean-inspired and plant-forward menus. Inventory discipline and category education should support stable per-capita consumption.

International horizons

- China: With tariffs partially normalized and consumer demand rising, 2026 is positioned for measured expansion in e-commerce, premium retail and bakery/café channels.

- Mexico: Continued kernel focus and potential policy wins could unlock broader household adoption.

- India: Seasonal festival demand and year-round premium snacking habits makes India a must-serve country.

- Europe and MENA: Tighter quality standards in Europe favor U.S. compliance and reliability. MENA’s premium retail and confectionery sectors continue to scale pistachio-centric SKUs.

Competitive context: The U.S. advantage

Iran’s strength in kernel exports and Turkey’s growing planted area present real competition. But in 2025-26, downward revisions in those origins and carryover-driven dynamics created a market that favored U.S. consistency, especially for premium in-shell grades and compliant kernels.

The U.S. is structurally positioned to retain leadership even as global supply grows more complex. Institutional research further situates the U.S. at the top of global output with over 60% share in recent years, and with California as the epicenter of production.

For 2026, expectations are for steady growth rather than explosive gains, as the industry consolidates capacity and optimizes water and labor inputs under California’s evolving regulatory frameworks.

What growers, handlers and brands should do in 2026

- Lean into kernels without abandoning premium in-shell. Keep cracking capacity and QA scalable, but safeguard in-shell brand equity.

- Diversify export exposure and plan for policy volatility. Balance China, Mexico, India, Europe and MENA allocations; support agility for tariff or inspection shifts. Expansion in Brazil and future Asian markets is a priority.

- Invest in quality systems and storytelling. European and global buyers reward consistent food safety and origin transparency — pair technical excellence with consumer-friendly education. Marketing pairs technical excellence with consumer-friendly education to connect consumers.

- Optimize agronomy for alternate bearing. Use pruning, nutrition and irrigation strategies to mitigate on/off swings and align harvest logistics.

- Champion category growth domestically. Collaborate with retailers on nutrition-led messaging, multipack formats and seasonal merchandising to sustain per-capita gains.

The bottom line

2025 was a watershed year for American pistachios: record receipts, rebounding shipments and strategic wins in priority export markets. 2026 will build on that base, but success will hinge on nimble export execution, kernel-forward innovation, and continued investment in orchard performance and processing excellence.

The global market is competitive — and at times contentious — but the U.S. advantage in scale, quality and compliance is tangible. If the industry sustains its momentum and navigates policy crosscurrents with the same discipline it applies in the field, 2026 will indeed be the year of American pistachios (again), both domestically and internationally