Mar/Apr 2022

Stretching fertilizers

It’s no surprise now that supply chains have been disrupted across the board. What growers – and everyone from processors to retail consumers – are experiencing are very unique market conditions, augmented by the highest inflation numbers since the 1980s. Some are COVID-related, some not, but the rising tide of the costs of materials has affected everyone.

Every supply chain has its particular nuances and fundamentals. With the first signs of logistics trouble in California agriculture with the inability to move tree nuts, the domino effect reached all of agriculture, including inputs and growers’ ability to obtain them.

Some suppliers have found themselves in a unique position in this situation. While some products are difficult to get a hold of, other lesser-known options are sitting on shelves waiting to be proven in the field for skeptical growers.

Matt Nicoletti, director of business development at Penny Newman, has found himself in this exact scenario.

UAN32 is the most widely used synthetic nitrogen (N) source for California tree nuts. About 14 million tons of UAN32 are consumed in the U.S. annually, with about 12 million tons produced domestically, making the country pretty self-reliant when it comes to synthetic nitrogen.

“California is sort of the inverse of that because we are a coastal region,” said Nicoletti. “We actually import more than half a million tons a year when our consumption in California is three-quarters of a million tons.”

It’s a large disparity when most of California’s UAN32 is imported, but less than a fifth is for the rest of the country. Part of this has to do with the current discussion surrounding unique regulations discussing anti-dumping and countervailing duties.

Russia has been a large supplier of UAN32 to the U.S., particularly to California. The U.S. Department of Commerce found that Russian imports of UAN are sold at less than fair value into the U.S. at rates ranging from 9.15% to 127.19%, and imports from Trinidad and Tobago at rates over 63%. Because of this, the Department of Commerce will impose cash deposit requirements on UAN imports from these countries.

It’s possible this might create a self-fulfilling prophecy of driving fertilizer costs even higher. The anticipation of tariff announcements has UAN32 importers uneasy about committing to a price when nobody knows what the additional costs will be. The months-ahead planning that usually takes place can’t happen.

“An importer can get upside down on that trade very quickly, depending on how punitive those tariffs are,” said Nicoletti. “And what will ultimately happen is nitrogen prices being driven higher because there will be at least a short-term shortage of inventories because the importers are afraid to build those stocks at the ports.”

In December 2020, the UAN32 wholesale offer was approximately $195 FOB Stockon from the importers, said Nicoletti. That same offer, if one can be obtained given the tariff uncertainties, goes for $655 as of late January 2022.

Nicoletti anticipates this being the situation at least through the third quarter of 2022. Once the variables are more ironed out, then the trades and vessel logistics can be lined up, but the first boat won’t show up for a couple of months.

By then, growers will be well into the growing season.

This course of action is following a similar playbook for that of phosphorus in late 2020 and early 2021, when the U.S. Department of Commerce and U.S. International Trade Commission determined phosphate fertilizer products from Russia and Morocco were damaging the industry domestically, and issued countervailing duty orders.

“It’s ultimately to the benefit of the domestic producer of these inputs,” said Nicoletti.

For growers, the fertilizer supply chain issue is on top of an already concerning environment with pressures from increasing labor and input costs and regulation.

But for some retailers, it’s becoming a very unique opportunity.

“The budgets that we’re writing for growers are significantly cheaper, on a relative basis, than they were a year ago, because the types of things that we’re drastically reducing, as far as inputs are concerned, are the fertilizers that have seen the greatest appreciation over the last 12 months,” said Nicoletti.

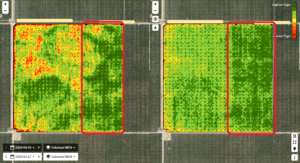

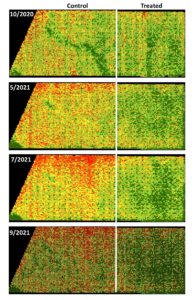

Take UAN for an example. An almond and tomato grower did an alternative program in 2021 and used 50% fewer N units than is recommended by University of California, Davis, for best practice. Traded dollar for dollar in an input budget, the money saved on reduced N use was spent on things that optimize that same nitrogen’s efficiency, things that allow growers to affix atmospheric N, and have different – and complementary – modes of action from one another so that supplemental N is not required to the same extent due to the efficiency gained.

The issue of perception is still a market challenge for companies with options to counterbalance the fertilizer issue. The hesitancy to try something new could be the result of a past bad experience, but it can also be due to a strict adherence to a budget and no room for error.

If a budget is for the things a grower needs, knows and trusts, and suddenly that cost has tripled in a 12-month period, many growers won’t try something new because it doesn’t fit into the budget, especially if they’re unfamiliar with the products.

“But then there is another type of mindset that is, ‘These market conditions are really underscoring our need to change our practices and learn about these new tools,’” said Nicoletti, “and it’s becoming more common.”

There is also a bit of a cushion regarding supply chain disruptions. Efficiency enhancers are used at such a low rate – ounces versus gallons or tons on a per-acre basis – that they’re less affected by supply chain disruptions.

Not only that, but so is the prominence of the regenerative agricultural movement, which is also seeing a rise in both growing incentives and educational incentives that are popularizing the benefits of soil health and biology.

“Those benefits really are numerous. Soil health and regenerative ag are growing in prominence and popularity, biological inputs are growing in prominence and popularity, and growers are realizing that regardless of how much fertilizer costs 5-10 years from now, there is going to be a big paradigm shift in input utilization and strategies,” Nicoletti said.

Even with a recent 13% increase in consumer cost, it pales in comparison to the over 300% increase seen for fertilizers. In the case of the tomato grower, that 50% reduction in N made the new program $50 cheaper per acre. This year, that same regimen is now $110 cheaper per acre, explaining the concept behind being significantly cheaper on a relative basis.

And it’s perfectly normal for growers to be incredulous or skeptical, but they’ve also become more amenable to learning given the growing prominence of a more biological approach. An educational approach has been the most beneficial, including explanations given by the innovators themselves who have mastery over their products, as well as live demonstrations. Penny Newman does this for Aqua-Yield, Corigin, LiveEarth and others.

“Necessity is the mother of invention, as they say. I would say that the current market conditions are just creating an environment in which growers are more curious and more willing to believe things that they would typically be apprehensive about,” said Nicoletti.

The space for efficiency products was noisy before the supply chain issues entered the scene, and there are no signs of that going away. As products continue to pour into the marketplace, growers are left trusting their traditional budgets, past experience, and soil and tissue tests.

For growers who take the leap into an alternative program, weekly sap analysis can provide more of a real-time snapshot of nutrient mobilization in the plant, allowing for quicker action regarding any deficiencies. Focusing on budgets, making sure to fall beneath the conventional spend this year, and testing vigilantly in season can ensure that everything is operating as planned in a situation of constantly changing variables.