May 8, 2023RaboResearch report shows lift for tree nut prices

The RaboResearch report cites a drop in input prices, a better water outlook in California and improved logistics. Tree nut prices, pushed downward due to elevated inventories, are seeing a much-needed lift, according to the report.

As with producers of most crops, U.S. fruit and tree nut growers have had challenges in recent years, including higher input costs and logistical issues. Yet according to a Rabobank report, there are positive developments for the 2023-24 season.

Tree nut exports lag behind production

Tree nut exports account for about 70% of U.S. marketable tree nut production, with the largest share of shipments going to countries in Asia and Europe.

Tree nut exports account for about 70% of U.S. marketable tree nut production, with the largest share of shipments going to countries in Asia and Europe.

Almonds

U.S. almond production almost tripled from the early 2000s to 2020. The following two seasons experienced challenges, and production declined as yields were impacted by weather events and an irrigation deficit in some areas.

Walnuts and pistachios

U.S. walnut and pistachio production also recently set production records. The unprecedented carry-in into the 2022-23 marketing season was an undesirable consequence of logistics constraints and subdued global demand.

Tree nut exports set record

U.S. tree nut exports set a record in 2019, surpassing $9 billion, according to the USDA. With prices under pressure due to increased inventories, the value of tree nut exports in 2022 was 5% lower than in 2019, despite a 12% volume increase. Shelled almonds and in-shell walnuts were the categories with the largest decline in export value from 2019 to 2022.

According to industry data, exports of almonds, walnuts and hazelnuts were down 11%, 9% and 9% year-over-year (YOY), respectively, during the 2021-22 marketing year. Pistachio production set a record in 2021-22, but exports remained below the record set in 2018-19.

Tree nut exports, prices rising

U.S. tree nut exports have been showing better numbers in recent months. Almond exports for the 2022-23 marketing season are up about 12% YOY through March, with exports in December, January, February and March increasing 24%, 47%, 29% and 24% YOY, respectively.

Walnut exports in January showed a 25% YOY increase, reaching a multi-year high volume for January.

The U.S. pistachio crop in 2022 was significantly lighter than in the previous two seasons, pistachio exports are up 7% YOY for the 2022-23 marketing season through February.

Improving exports and the prospect of more manageable tree nut inventories at the end of the 2022-23 marketing season have been reflected in a much-needed price lift in the past couple of months. Another relevant factor that will influence prices in the coming months is the size of the 2023 crop. Almond yields will likely be lighter as cold and wet weather prevailed during the blooming/pollination season. Weather conditions are expected to be better for pistachio and walnut bloom periods, but it is too early to pin down yield expectations.

Global fertilizer prices

The cost structure of the fertilizer complex is driven by high-demand commodities such as corn, soybeans, and wheat. Tree and fruit nuts are submected to the major agri-commodities’ influence on prices.

The cost structure of the fertilizer complex is driven by high-demand commodities such as corn, soybeans, and wheat. Tree and fruit nuts are submected to the major agri-commodities’ influence on prices.

The Russia-Ukraine war and Belarusian sanctions also implacted global fertilizer prices, which skyrocketed in 2022, exacerbating global affordability to levels comparable to 2008.

Input costs easing

Fertilizer price momentum has been trending downward, the consequence of which can often be a slow proliferation through the value chain of the products. Though this slow movement through the value chain is most evident in pure-play commodity products, the negative price trajectory could improve the cost structure for many of the specialty inputs used in fruits and tree nut production.

Where the bottom lies for these macronutrients depends on many factors that are yet to be determined by the markets. Still, there are indications that prices for both potash and phosphate could continue to fall in the medium-to-short term.

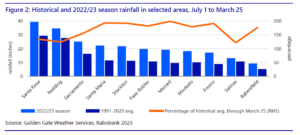

Improved water conditions in California

The improved water outlook has come at the short-term cost of increased use of herbicide and fungicide in some crops to manage a wetter environment. In the longer term, however, current wet conditions will benefit farmers, particularly those who are able to maximize water banking for future dry years.

The improved water outlook has come at the short-term cost of increased use of herbicide and fungicide in some crops to manage a wetter environment. In the longer term, however, current wet conditions will benefit farmers, particularly those who are able to maximize water banking for future dry years.

Logistics entering the shipping market

Challenges related to shipping and other logistical factors will be eased in 2023 compared to recent years. The report indicates a down cycle characterized by overcapacity in shipping equipment and vessels.

Prices have adjusted significantly down from their peak in 2021, although they are still likely to remain above pre-pandemic levels. Schedule reliability has greatly improved and is approaching pre-pandemic levels. Shippers will regain bargaining power as the supply-demand balance shifts toward oversupply over the next two years.

Packaging costs down

Paper and plastic packaging prices have surged beyond inflation in the past few years, costs will likely stabilize or even decline over the next 12 to 18 months. Both the container board and relevant plastic resin markets face an oversupply issue with additional capacity from both domestic and foreign markets entering the U.S.

In the short term, we expect a period of predictable packaging costs and stable packaging supply for fruit and tree nut exports.

In the long term, sustainability concerns around packaging, especially plastics, will continue to create cost and operational challenges for exporters. Recyclable and compostable options are available, but at higher prices and with lower barrier performance. Commercially viable sustainable packaging alternatives may still be several years away.

For more information, read the full RaboResearch report.