September/October 2023

Effective succession planning: Developing a successful plan is more than who gets what and when

No one really plans to fail; however, many farm families fail to plan. Farm succession planning is a process that takes time and focus. An effective plan can enhance family harmony and financial security.

But done poorly — or left to chance — the end result could be a financial disaster and create broken family relationships that may never recover.

Succession planning is not just a matter of who gets what and when. While that is important, the real planning starts with understanding the financial needs of the senior generation, while preparing the next generation to lead.

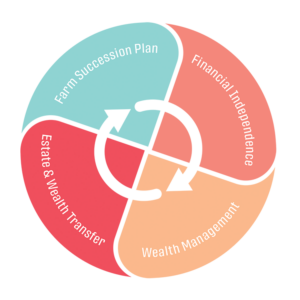

An effective farm succession plan includes four components:

Financial independence

For the senior generation, this is critical for a successful plan, and answers the question, “Are we okay?”

Where will mom and dad find the income coming in (for life) that exceeds their everyday living expenses? What if inflation remains high? How can they hedge foreseeable risks, like longevity (outliving their savings) or the odds they will require long-term care?

Wealth and asset management

In transferring the farm to the next generation, mom and dad may need to transition from familiar income sources (farm income, land rents) to investments which may feel foreign to them. How should investments be structured to weather the various financial storms that will come? How can investments be structured to align with mom and dad’s risk tolerance? If farmland plays a role, how can leases be structured to protect the farming operation and allow it to prosper, while at the same time provide for mom and dad?

In some cases, part of mom and dad’s income may come from the next generation purchasing farmland or operating assets. How can that sale be structured to minimize taxes and protect the farming operation, yet provide adequate income for mom and dad?

Estate and wealth transfer plan

Estate and wealth transfer plan

Many farm families have children who are active in the operation as well as those who are not. A common dilemma is how to provide a fair inheritance to inactive heirs without harming the operation or creating

family conflict.

The estate plan should address where assets go at first death and second death. The questions of “fair versus equal” should be addressed, as well as identifying a plan to minimize and

pay estate taxes. There are many strategies that can reduce, freeze, or in some cases, eliminate the estate and income taxation associated with death. If so, would this be appropriate in your situation?

The following questions are examples

of some topics that should be considered when developing an estate plan. Is the financial independence plan so secure that lifetime gifting may be considered? If so, what are the appropriate strategies to use? If estate taxes cannot be eliminated, what is the most efficient method of paying those taxes?

Questions such as these are important and should be discussed with your financial planner, tax accountant and/or attorney.

Written farm succession plan

In our experience, a plan not in writing is a wish, not a plan. But an effective farm succession plan means more than just who will own the operation and when.

On the people level, is the next generation prepared to lead? Are mom and dad empowering the next generation of leaders in the family? Have you identified weaknesses in management, operational or relational skills in your future leaders? If so, how are you providing training to master the necessary skills?

Does the family have open and honest communication between active and inactive members, and do they trust one another? Do all members of the family — and their spouses — understand what the plan is? If not, will the lack of communication cause conflict within your family?

These issues should be addressed before transferring control and ownership to the next generation.

The process may be more far-reaching than you expected. Some of the topics are foreign to many farm families (such as the financial independence and wealth management portions), and the best results may come from a team effort. Your CPA and attorney may play valuable roles in this process; however, you may benefit from having a “quarterback” with specialized expertise. The quarterback takes direction from the coach (mom and dad) and helps to implement the game plan.

In our next article, we will address why every operation needs two succession plans for complete financial security.

Agribusiness Succession Advisors Jeffrey DeWald and Michael Cohen are registered representatives of and offer securities and advisory services through Lincoln Financial Advisors Corp., a broker-dealer (member SIPC) and registered investment advisor. This information should not be construed as legal or tax advice. You may want to consult a legal or tax advisor regarding this information as it relates to your personal circumstances. CRN-5727541-060723